Lately, there has been a lot of talk about a reassessment of portfolio theory and treating gold as a necessity, rather than an option. This came primarily as a result of the global bond market suffering a quiet collapse, with yields on most sovereign bonds falling to zero or dipping in negative territory. (Yields look even worse when you factor inflation into your calculations.) The Treasury, too, has been subject to the fall of the bond market with its ongoing all-time low showings.

Portfolio managers are indeed beginning to view gold as an alternative to bonds and accepting it as a necessary diversification. Even so, most investors remain underweight.

Prominent pundits like Frank Holmes, CEO of U.S. Global Investors, recommend a 10% allocation to gold to all investors. Many who aren’t keen on precious metals still view it as too high, despite what history has shown us.

Now there’s a voice saying that Holmes’s 10% gold allocation just isn’t good enough.

10% gold allocation might not be enough

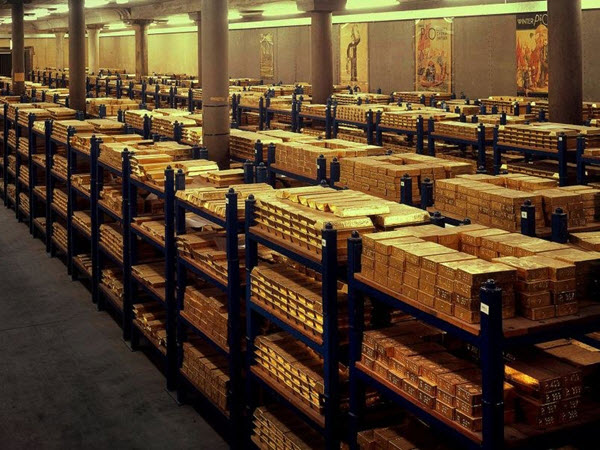

Egyptian billionaire Naguib Sawiris finds this allocation all too low. In 2018, Sawiris revealed that he had allocated 50% of his $5.7 billion net worth into gold, along with a group called the Shareholders’ Gold Council. Sawiris has since lowered his gold allocation, perhaps to gather capital to start his recently-launched $1.4 billion gold mining fund.

Still, as he recently told CNBC, he recommends that all investors should keep their gold allocation between 20% and 30% of their total savings.

Here’s why Sawiris thinks more gold is better

Sawiris, like all gold investors, wants the safety that no other asset can provide. Last year’s pandemic has shown the extent, magnitude and quickness with which a crisis can hit, and it is one we are still very much in. In his interview with CNBC, Sawiris also spoke about the situation in Afghanistan, which has all the markings of something that could destabilize the entire Middle East.

While these particular comments weren’t tied to gold, there are already comparisons drawn between the Vietnam war and the Afghanistan war. It’s the kind of geopolitical turmoil that affects everyone involved and can cause severe disruptions, and precisely the kind of scenario that highlights the value of gold’s independence. After all, those Vietnamese refugees who held onto their physical precious metals found themselves on the most solid footing after fleeing.

Sawiris reiterated as much, saying that gold is something that has always been around and can be counted on to remain valuable. For the Western investor, gold is a safe haven providing peace of mind without worrying about stock, bond or fiat crashes or a crisis of any sorts. The greater the allocation, the lesser the worry, and the less dramatic the financial fallout when trouble arrives.

Sawiris said that he very much appreciates this safe-haven aspect of owning physical gold. In addition to the ongoing economic issues previously mentioned, he said today’s stock market might be worth keeping an eye on. Stock prices continue to barrel on despite record valuations in what is now by far the most decrepit bull run in history.