According to data published by the World Gold Council, global central banks haven begun adding to their gold stockpiles. In February, the following nations added to their reserves:

- India (11.2 tons)

- Uzbekistan (7.2t)

- Kazakhstan (1.6t)

- Colombia (0.5t)

The only notable sale of central bank gold reserves was from Turkey at 11.7 tons.

Why did Turkey’s central bank sell gold?

Nations hold gold reserves as a sort of collateral against their sovereign currency. Turkey’s currency, the lira, had a horrible day on March 22 and lost 20% of its value. In response, Turkish President Recep Tayyip Erdogan made an appeal:

I ask my citizens to invest their foreign currencies and gold in various financial institutions and bring [those assets] into the economy and production.

via BalkanInsight

Put simply: if his people listened to Erdogan’s plea and swapped all their U.S. dollars and euros and precious metals for lira, demand for lira would increase. And therefore prices would increase. It’s reasonable to assume the Turkish central bank sold gold in order to buy lira in an effort to prop up the beleaguered currency.

Note that even after this sale, Turkey has a respectable 716 tons of gold reserves.

What other central banks are buying gold?

More recently, central bank gold purchases have been in the news.

This month, Hungary announced its intention to triple its gold reserves “to help stabilise the economy amid the COVID-19 pandemic, inflation risks and rising debt.”

Back in March, Poland decided to buy 100 tons of gold.

The Reuters article even hints at a possible explanation…

Over the last decade central banks, particularly in Eastern Europe, the Middle East and Asia, have stepped up purchases of gold, often seeing it as a way to reduce reliance on assets such as the U.S. dollar.

Reuters

Is central bank gold buying a bad sign for the dollar?

Not necessarily. Most central banks around the world hold a combination of foreign exchange reserves (a collection of the world’s most-used and/or most-stable currencies) in bonds as well as gold or other precious metals.

So, in a sense, any government that issues bonds is competing for central bank customers. For the most part, only the most common currencies are considered useful as foreign exchange reserves. According to the IMF, the top five are:

- U.S. dollar

- euro

- China’s renminbi

- Japan’s yen

- U.K.’s pounds sterling

So anytime the U.S. Federal Reserve, the Bundesbank or the Bank of England issues a bond (a promise to pay later for cash now, or an IOU), there are other global central banks who are potential customers. Along with them, what you might think of as the “traditional” customers for bonds like pension funds, insurance companies, individual savers, etc. also want bonds. More customers means more demand, and more demand means higher prices.

But what if some of that central bank demand is diverted out of bonds, into gold?

That means a diminished demand for bonds. That means a slight upward pressure on the interest rate issuing banks must offer to attract buyers. Which makes deficit spending more expensive. Sovereign bonds can also lose value to inflation.

Further, as mentioned in the Reuters article, gold isn’t subject to counterparty risk. There’s always the chance, however small, that a nation might choose to stop paying its bond-holders. (This is called a default, or a sovereign debt crisis, and they happen fairly regularly.)

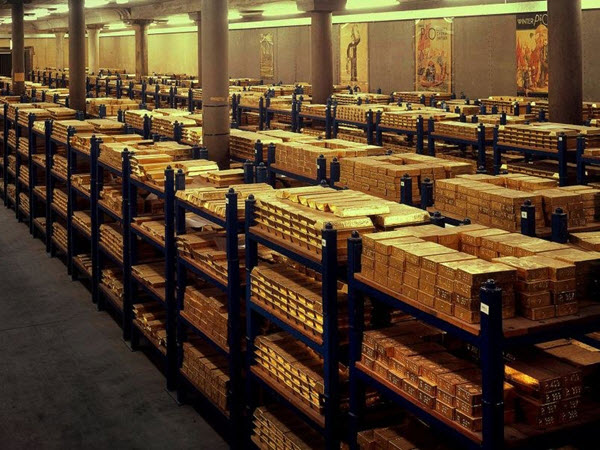

There’s zero chance of physical gold defaulting. Once those gold bars are locked up in a nation’s central bank vaults, it serves as a permanent store of value.

In an important sense, when a central bank chooses to add to their gold reserves, the decision says, “We’re diversifying our country’s savings out of currencies we don’t control, into an asset class that we can trust.”

Leave a Reply