As seen in the World Gold Council’s Gold Demand Trends report for 2021’s second quarter, gold managed to shed its losses from the first quarter and post an overall 4% price gain in Q2. Certain hawkish statements made by the Federal Reserve weren’t enough to balance inflation concerns, a weaker dollar and negative real interest rates.

Gold demand just keeps growing

Gold demand intensified on all fronts, including a somewhat surprising return by funds after their massive outflows in the first quarter. While the report states that there is still room for improvement in terms of jewelry demand, consumer purchases have nonetheless posted a considerable recovery, especially as economic conditions remain sluggish in many areas of the world.

Overall, jewelry demand in Q2 totaled 390.7 tons, a 60% year-on-year increase. The biggest buyer was China, whose 146.9 tons amounted to a 62% year-on-year increase. Chinese consumers purchased 338 tons of gold in the first six months of 2021, a 122% year-on-year increase. Remarkably, the figure is also 6% higher than the amount of jewelry purchased in the country in first half of 2019. Despite economic woes, India posted a 25% year-on-year increase in jewelry purchases, with similar rises happening across most of the Middle East.

Western jewelers also had a notable showing, with 37.7 tons of jewelry demand in Q2 2021 marking the strongest showing for the quarter since 2007. Investment demand in the U.S. was another important point, with retail investors buying 30 tons in the second quarter. The amount of gold bought in the first half of 2021 was brought to a record 61.7 tons. Chinese retailers and individual investors made the most of lower premiums and a stronger economy, buying 57.3 tons of gold in Q2. This represented a 41% year-on-year increase and a 16% increase over the second quarter of 2019.

Worldwide demand for gold bars saw an 18% year-on-year increase, while gold coin demand rose by 7% compared to the same quarter last year. And not all of the buyers were private investors.

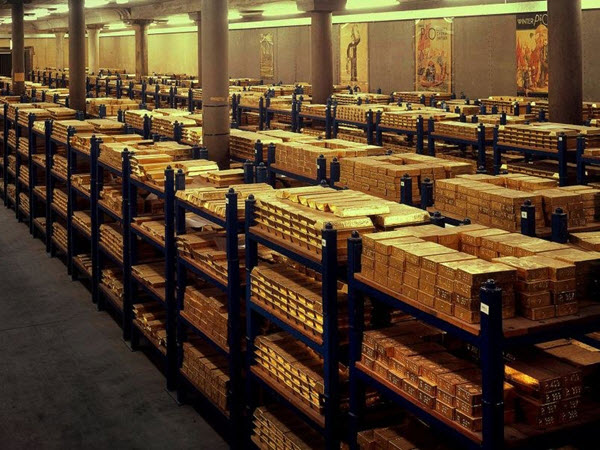

Central bank gold buying significantly higher

Central banks posted their third consecutive quarter of net buying despite many instances of nations resorting to selling. Demand from the official sector was all the more notable due to the diversity of buyers, with Thailand purchasing 90.2 tons of gold in the first half of the year. It was joined by many other relative newcomers, such as Hungary which bought 62.09 tons of gold during the same period and Uzbekistan with purchases amounting to 25.50 tons.

The overall 214% year-on-year increase in central bank purchases was conspicuous, but perhaps expected given the conditions of last year.

Industrial demand for gold rising, too

Despite disruptions in the technological sector, gold demand was still strong across the board, with an overall 18% year-on-year increase of 80 tons bought during the second quarter. Electronics demand rose the most, 16%, while dentistry recorded its first year-on-year increase in 17 years with 12%.

Other industrial demand rose from 8.3 tons in Q1 to 10.8 tons in Q2, a 31% year-on-year increase.