Recent military flare-ups have reminded investors that peace is not a mainstay. The U.S. has, economics aside, not truly been impacted by war in some decades. These days, however, we have President Biden saying that the U.S. will side with Taiwan if China attempts to invade it with its considerable military might. Russia, too, seems keen on taking over Ukraine and therefore pulling the rest of the world into the conflict.

Things like this reiterate that having a good, well-functioning military is important. Many will be ready to say that the U.S. has not been impacted by war in decades primarily because of its status as the largest military superpower. But how many know that gold is playing a key role in the military’s defenses?

Gold: as crucial in warfare as “beans and bullets”

The average investor cares about gold’s price quite a bit, and even the non-average ones will pay attention to them. The military-industrial complex does not. The army wants, and indeed needs, the best tools made from the best materials at all times. If gold is a key component in military systems, it doesn’t matter if an ounce is $50, $500 or $5,000. And a key component it is. In an interesting, if expected way, the military likes gold for similar reasons that investors do.

Anti-oxidation coatings

Oxidization is a process that turns metals into scrap, and gold doesn’t oxidize. Coating missile components in gold will protect them from environmental conditions such as heat or humidity that would quickly ruin other metals and certainly delicate components.

Thermal protection

Lack of corrosion is just the start, though. Gold not only handles heat well, but it spreads it out much better than other materials. Plating a piece of military hardware with gold will allow it to withstand temperatures of up to 257 degrees Fahrenheit. Use another material, and your missile might explode prematurely.

Low-friction qualities

Even more, gold plating lowers friction with other materials. Ground defense systems use a lot of moving components, as do other military staples. This means wear and tear, a nasty side-effect that can be avoided by coating various parts of the object in gold. All of this is made possible by gold’s extreme permeability.

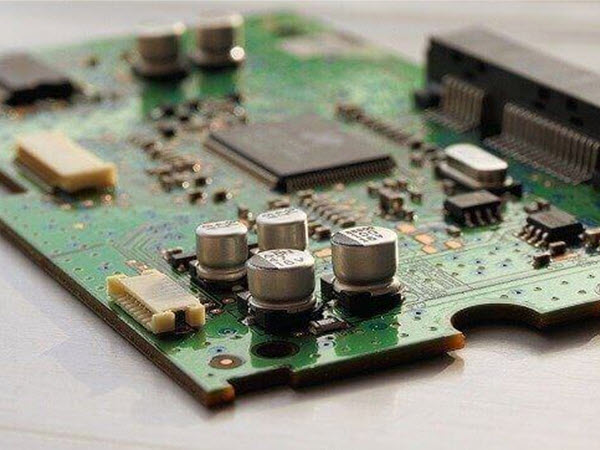

Conductivity

It’s well-known that gold is one of the most liquid assets in finance. Besides being traded by the billion every day, you might find a place where you can’t buy gold, but you aren’t likely to find one where you can’t sell it.

This liquidity translates in the most literal sense in military use. It allows engineers to place gold virtually anywhere inside a piece of hardware, whether for aforementioned shielding or in order to facilitate electrical conductivity. As any chemist can tell you, gold is the most conductive material, beating the widely-used copper by a fair margin.

And, since it doesn’t erode as opposed to copper and other metals, its use in military components can allow them to last for decades whereas they might otherwise break much sooner.

Adding it all up

Over 320 tons of gold are used in the electronics industry every year, and if more was used, built-in obsolescence might not be a thing.

Then there’s appearance, too. We all know about gold jewelry. We like it, but not as much as people in Asia. But if you thought that the military-industrial complex doesn’t like it, you’re kidding yourselves.